Corporate Governance Report

An Overview of Corporate Governance

The Company strives to maintain high level of corporate governance and has always adhered to excellent, prudent and efficient corporate governance principles and continuously improves its corporate governance methodology, regulates its operations, improves its internal control mechanism, implements sound corporate governance and disclosure measures, and ensures that the Company’s operations are in line with the long-term interests of the Company and its shareholders as a whole. In 2019, the shareholders’ meeting, the Board and the Supervisory Committee operated soundly and efficiently. The Company was dedicated to lean management while ensuring stable and healthy operation, and elevated its high-quality development to a new level, while continuously optimising its internal control system and comprehensive risk management in order to effectively ensure steady operation of the corporate. The standard of the Company’s corporate governance continued to improve and is aligned with the long-term best interest of the shareholders, ensuring that the interests of the shareholders were effectively assured.

The Company persists in refining the basic system of its corporate governance. As a company incorporated in the People’s Republic of China (the “PRC”), the Company adopts the Company Law of the People’s Republic of China and other relevant laws and regulations as the basic guidelines for the Company’s corporate governance. As a company dual-listed in Hong Kong and the United States, the Company strives to ensure compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and the regulatory requirements for non-US companies listed in the United States.

In addition, the Company has regularly published statements relating to its internal control in accordance with the US Sarbanes-Oxley Act and the regulatory requirements of the U.S. Securities and Exchange Commission and the New York Stock Exchange to confirm its compliance with related financial reporting, information disclosure, corporate internal control requirements and other regulatory requirements.

For the financial year ended 31 December 2019, the roles of Chairman and Chief Executive Officer of the Company were performed by the same individual. In the Company’s opinion, through supervision by the Board of Directors (the “Board”) and the Independent Non-Executive Directors of the Company, with effective control of the Company’s internal check and balance mechanism, the same individual performing the roles of Chairman and Chief Executive Officer can enhance the Company’s efficiency in decision-making and execution and effectively capture business opportunities. Many leading international corporations around the world also have similar arrangements. Save as stated above, the Company was in compliance with all the code provisions under the Corporate Governance Code as set out in Appendix 14 to the Listing Rules (the “Corporate Governance Code”) in the year 2019.

In 2019, the Company’s continuous efforts in corporate governance gained wide recognition from the capital market and the Company was accredited with a number of awards. The Company was voted as the “Most Honoured Company in Asia” in the 2019 All-Asia-Executive-Team poll organised by Institutional Investor, a prestigious international financial magazine, for nine consecutive years. The Company was accredited with “Platinum Award – Excellence in Environmental, Social and Governance” in the poll of Corporate Awards 2019 by The Asset, and was the only telecommunications company in the region which had received the Platinum recognition for 11 years in a row. Meanwhile, the Company was awarded “Highly Commended Initiative in Innovation” for its “Cloudification in 5G” strategy, which refers to the comprehensive upgrade of services and network to cloud in terms of infrastructure, products service capabilities and sales mode, with a focus on cloud computing. In addition, the Company was awarded, for the 12th time, “The Best of Asia – Icon on Corporate Governance” by Corporate Governance Asia, a renowned regional journal on corporate governance. Mr. Ke Ruiwen, the Chairman and Chief Executive Officer of the Company, was honoured with “Asia’s Best CEO” award. The Company was also accredited the awards including “No. 1 Best Managed Company”, “No. 1 Best Investor Relations” and “No. 1 Best ESG” in China region in Asia’s Best Managed Companies Poll 2019 by FinanceAsia.

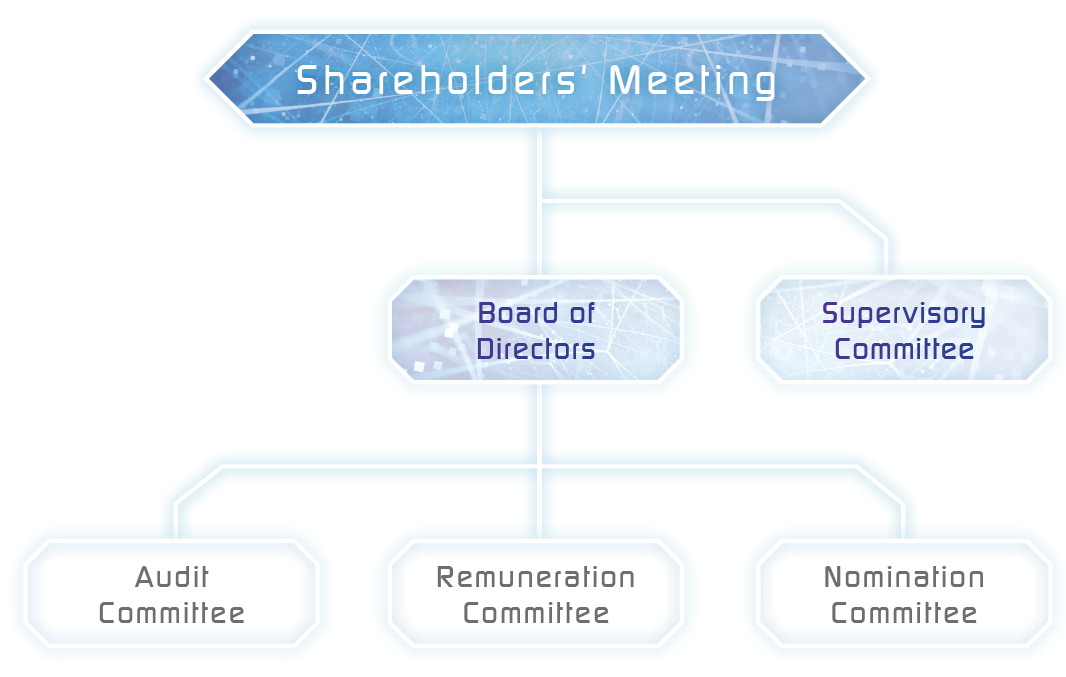

Overall Structure of the Corporate Governance

A two-tier structure is adopted as the overall structure for corporate governance: the Board and the Supervisory Committee are established under the shareholders’ meeting; the Audit Committee, Remuneration Committee and Nomination Committee are established under the Board. The Board is authorised by the Articles of Association to make major operational decisions of the Company and to oversee the daily management and operations of the senior management. The Supervisory Committee is mainly responsible for the supervision of the performance of duties of the Board and the senior management. Each of the Board and the Supervisory Committee is independently accountable to the shareholders’ meeting.

Shareholders’ Meeting

In 2019, the Company convened 3 shareholders’ meetings including an annual general meeting for the year 2018 (the “2018 Annual General Meeting”) and 2 extraordinary general meetings.

On 18 April 2019, the Company held the first extraordinary general meeting in Beijing to approve the deposit services and the annual caps applicable thereto and related matters contemplated under the China Telecom Financial Services Framework Agreement between the Company and China Telecom Finance Co., Ltd (“China Telecom Finance”) entered into on 1 February 2019. The relevant resolution was duly passed and approved by the independent shareholders.

On 29 May 2019, the Company held the 2018 Annual General Meeting in Hong Kong to approve the following resolutions, all of which were duly passed and approved by the shareholders of the Company.

- To approve the consolidated financial statements of the Company, the report of the Directors, the report of the Supervisory Committee and the report of the international auditor for the year ended 31 December 2018 and to authorise the Board to prepare the budget of the Company for the year 2019;

- To approve the profit distribution proposal and the declaration and payment of a final dividend for the year ended 31 December 2018;

- To approve the re-appointment of Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP as the international auditor and domestic auditor of the Company respectively for the year ending on 31 December 2019 and to authorise the Board to fix the remuneration of the auditors;

- To approve the amendments to the Articles of Association and to authorise any Director of the Company to complete registration or filing of the amendments to the Articles of Association;

- To approve the issue of debentures by the Company, to authorise the Board to issue debentures and determine the specific terms, conditions and other matters of the debentures and to approve the centralised registration of debentures by the Company;

- To approve the issue of company bonds in the PRC and to authorise the Board to issue company bonds and determine the specific terms conditions and other matters of the company bonds in the PRC;

- To grant a general mandate to the Board to issue, allot and deal with additional shares in the Company not exceeding 20% of each of the existing domestic shares and H shares in issue; and

- To authorise the Board to increase the registered capital of the Company and to amend the Articles of Association of the Company to reflect such increase in the registered capital of the Company under the general mandate.

On 19 August 2019, the Company held the second extraordinary general meeting in Beijing to approve (i) the election of Mr. Liu Guiqing and Mr. Wang Guoquan as Directors of the Company, to authorise any Director of the Company to sign the Director’s service contracts on behalf of the Company with them and to authorise the Board to determine their remuneration; and (ii) the amendments to the Articles of Association and to authorise any Director of the Company to complete registration or filing of the amendments to the Articles of Association. All resolutions were duly passed and approved by the shareholders of the Company.

Since the Company’s listing in 2002, at each of the shareholders’ meetings, a separate shareholders’ resolution was proposed by the Company in respect of each independent item. The circulars to shareholders also provided details of the resolutions. All votes on resolutions tabled at the shareholders’ meetings of the Company were conducted by poll and all voting results were published on the websites of the Company and the Hong Kong Stock Exchange. The Company attaches great importance to the shareholders’ meetings and the communication between Directors and shareholders. The Directors provided detailed and sufficient answers to the questions raised by shareholders at the shareholders’ meetings. The Board implemented the Shareholders Communication Policy to ensure that the shareholders are provided with comprehensive, equal, understandable and public information of the Company on a timely basis and to facilitate the communication amongst the Company, the shareholders and investors.

Board of Directors and Board Diversity Policy

As at 31 December 2019, the Board consisted of 11 Directors with 6 Executive Directors, 1 Non-Executive Director and 4 Independent Non-Executive Directors. There is no relationship (including financial, business, family or other material or relevant relationship) among the Board members. The Audit Committee, Remuneration Committee and Nomination Committee under the Board consist solely of Independent Non-Executive Directors, which ensures that the Committees are able to provide sufficient checks and balances and make independent judgements to protect the interests of the shareholders and the Company as a whole. The number of Independent Non-Executive Directors exceeds one-third of the members of the Board. Mr. Tse Hau Yin, Aloysius, the Chairman of the Audit Committee, is an internationally renowned financial expert with extensive expertise in accounting and financial management. As at the date of this report, the Board comprised 10 Directors, including 5 Executive Directors, 1 Non-Executive Director and 4 Independent Non-Executive Directors. The term of office for the current 6th session of the Board (including the Non-Executive Directors) lasts for 3 years, starting from May 2017 until the day of the Company’s 2019 Annual General Meeting to be held in 2020, upon which the 7th session of the Board will be elected.

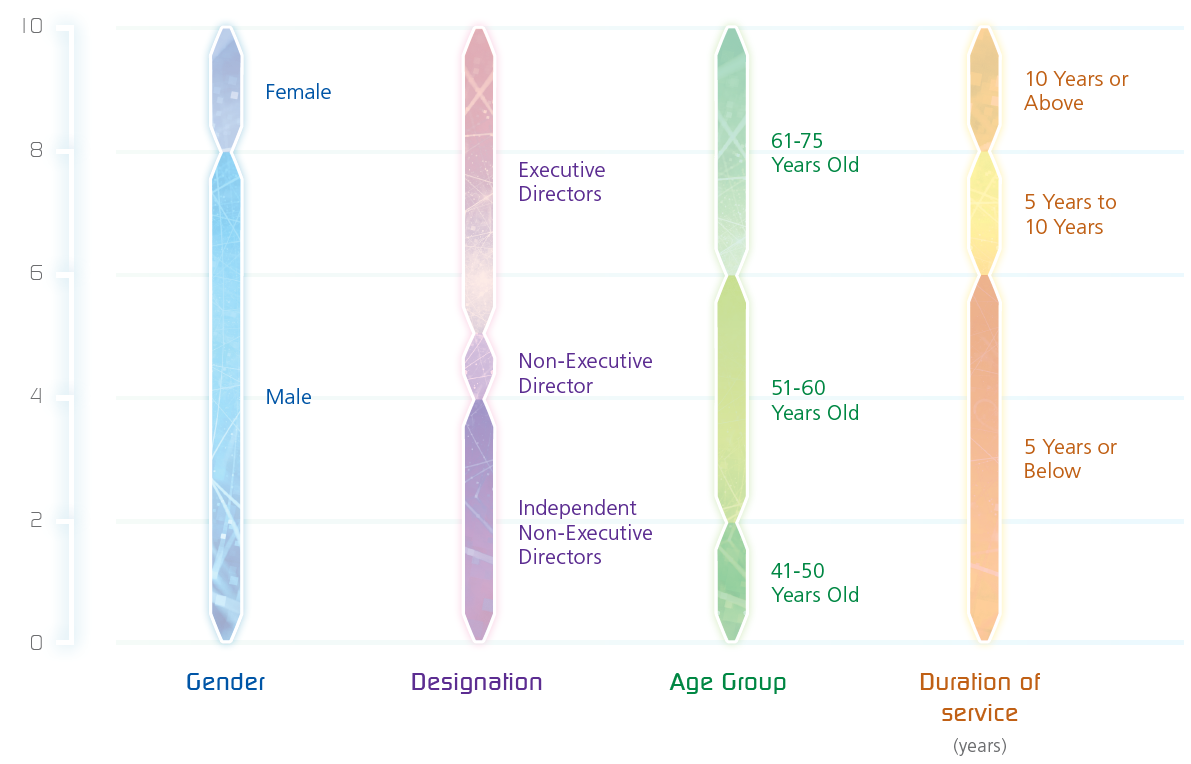

In August 2013, the Company implemented the Board Diversity Policy. The Company strongly believes that board diversity will contribute significantly to the enhancement of the overall performance of the Company. The Company views board diversity as the key element for accomplishing its strategic goals and sustainable development. In determining the composition of the Board, the Company takes into account diversity of the Board from a number of perspectives, including but not limited to gender, age, educational background, professional experience, skills, knowledge, duration of service and time commitment, etc. All appointments made or to be made by the Board are merit-based, and candidates are selected based on objective criteria taking full consideration of board diversity. Final decisions are comprehensively made based on each candidate’s attributes and the consideration for his/her value contributions to be made to the Board. The Nomination Committee oversees the implementation of Board Diversity Policy, reviews the existing policy as and when appropriate, and recommends proposals for revisions for the Board’s approval.

Biographical details of existing Directors are set out in the “Biographical details of Directors, Senior Management and Supervisors” section of this annual report. There are currently two female Directors on the Board. The Board currently comprises experts from diversified professions such as telecommunications, accounting, finance, law, banking, regulatory, compliance and management with diversification in terms of gender, age, duration of service, etc., advancing the enhancement of management standard and the further standardisation of corporate governance practices, which results in a more comprehensive and balanced Board structure and decision-making process. Each Director brings to the Board different views and perspectives. Both the Nomination Committee and the Board believe that the gender, age, educational background, professional experience, skills, knowledge and the duration of service of the Board members are in alignment with the Board Diversity Policy.

The Company strictly complies with the Corporate Governance Code to rigorously regulate the operating procedures of the Board and its Committees, and to ensure that the procedures of the Board meetings are in compliance with related rules in terms of organisation, regulations and personnel. The Board responsibly and earnestly supervises the preparation of financial statements for each financial period, so that such financial statements truly and fairly reflect the financial condition, the operating results and cash flows of the Company for such period. In preparing the financial statements for the year ended 31 December 2019, the Directors adopted appropriate accounting policies and made prudent, fair and reasonable judgements and estimates, and prepared the financial statements on a going concern basis.

The below chart sets out the analysis of the Board composition as at the date of this report:

The Articles of Association of the Company clearly defines the respective duties of the Board and the management. The Board is accountable to the shareholders’ meetings, and its duties mainly include the execution of resolutions, formulation of major operational decisions, financial proposals and policies, formulation of the Company’s basic management system and the appointment of senior management personnel of the Company. The management is responsible for leading the operation and management of the Company, the implementation of Board resolutions and the annual operation plans and investment proposals of the Company, formulating the proposal of the Company’s internal administrative organisations and sub-organisations, and performing other duties as authorised by the Articles of Association and the Board. In order to maintain highly efficient operations, as well as flexibility and swiftness in operational decision-making, the Board may delegate its management and administrative powers to the management when necessary, and shall provide clear guidance regarding such delegation so as to avoid impeding or undermining the capabilities of the Board when exercising its powers as a whole.

All members of the Board and Committees are informed of the meeting schedule for the Board and Committees for the year at the beginning of each year. In addition, all Directors will receive meeting notice at least 14 days prior to the meeting under normal circumstances. The Company Secretary is responsible for ensuring that the Board meetings comply with all procedures, related rules and regulations while all Directors can make enquiries to the Company Secretary for details to ensure that they have received sufficient information on various matters set out in the meeting agendas.

The Board holds at least 4 meetings in each year. Additional Board meetings will be held in accordance with practical needs. In 2019, the Company convened 4 Board meetings in total and completed various written resolutions; the Chairman held a meeting to independently communicate with the Independent Non-Executive Directors without the presence of any other Directors to ensure their opinions can be fully expressed, which further facilitated the exchange of different views within the Board. In 2019, the Board played a pivotal role in the Company’s operation, supervision, internal control, risk management and other significant decisions and corporate governance. Specifically, the Board reviewed matters including, but not limited to, certain financial services framework agreements entered into between China Telecom Finance and the Company, China Telecommunications Corporation (“China Telecommunications”) and China Communications Services Corporation Limited (“CCS”), respectively, the continuing connected transactions contemplated thereunder and the applicable annual caps thereto, the Company’s annual and interim financial statements, quarterly financial results, risk management and internal control implementation and assessment report, annual proposal for profit distribution, review of the structure and operations of the Board, two rounds of amendments to the Articles of Association, approval of authorisation granted to the Company to issue debentures, proposal for directors and senior management liabilities insurance, change of the principal place of business in Hong Kong, the implementation of continuing connected transactions, changes of Board members and senior management, remuneration proposal for the newly appointed Directors, re-appointment and remuneration of auditors, 5G network co-build and co-share framework cooperation agreement with China United Network Communications Corporation Limited, and the progress report on the preparation of the Environmental, Social and Governance Report.

The Company determines the Directors’ remuneration with reference to factors such as their respective duties and responsibilities in the Company, as well as their experience and market conditions at the relevant time.

The Board formulates and reviews the Company’s policies and practices on corporate governance; reviews and monitors the training and continuous professional development of Directors and senior management; reviews and monitors the Company’s policies and practices on compliance with legal and regulatory requirements; formulates, reviews and monitors the code of conduct for employees; and reviews the Company’s compliance with the Corporate Governance Code and disclosure in the Corporate Governance Report.

Directors’ training and continuous professional development

The Company provides guidelines including on directors’ duties, continuing obligations, relevant laws and regulations, operation and business of the Company to newly appointed Directors so that they are provided with tailored induction relating to their appointment. To ensure that the Directors are familiar with the Company’s latest operations for decision-making, the Company arranges for key financial data and operational data to be provided to the Directors on a monthly basis. Meanwhile, through regular Board meetings and reports from management, the Directors are able to have clearer understanding of the operations, business strategy, and the latest development of the Company and the industry. In addition, the Company reminds the Directors of their functions and duties by continuously providing them with information regarding the latest development of the Listing Rules and other applicable regulations, and arranging internal training on topics related to the latest development of the industry and operational focus of the Company for mutual exchange of ideas and discussion. The Directors actively participate in training and continuous professional development to develop and refresh their knowledge and skills in order to contribute to the Company.

During the year, the Directors have participated in training and continuous professional development activities, and the summary is as follows:

| Directors | Types of training |

|---|---|

| Executive Directors | |

| Ke Ruiwen | A, B |

| Chen Zhongyue | A, B |

| Liu Guiqing | A, B |

| Zhu Min | A, B |

| Wang Guoquan | A, B |

| Yang Jie* | A, B |

| Gao Tongqing* | A, B |

| Non-Executive Director | |

| Chen Shengguang | A, B |

| Independent Non-Executive Directors | |

| Tse Hau Yin, Aloysius | A, B |

| Xu Erming | A, B |

| Wang Hsuehming | A, B |

| Yeung Chi Wai, Jason | A, B |

A: attending relevant seminars and/or conferences and/or forums; or delivering speeches at relevant seminars and/or conferences and/or forums

B: reading or writing relevant newspapers, journals and articles relating to economy, general business, telecommunications, corporate governance or directors’ duties

* On 4 March 2019, Mr. Yang Jie resigned from his positions as an Executive Director, Chairman and Chief Executive Officer of the Company due to change in work arrangement. On 17 January 2020, Mr. Gao Tongqing resigned from his positions as an Executive Director and Executive Vice President of the Company due to change in work arrangement.

Compliance with the Model Code for Securities Transactions by Directors and Supervisors and Confirmation of Independence by the Independent Non-Executive Directors

The Company has adopted the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix 10 to the Listing Rules to govern securities transactions by the Directors and Supervisors. Based on the written confirmation from the Directors and Supervisors, the Company’s Directors and Supervisors have strictly complied with the Model Code for Securities Transactions by Directors of Listed Issuers in Appendix 10 to the Listing Rules regarding the requirements in conducting securities transactions for the year 2019. Meanwhile, the Company has received annual independence confirmation from each of the Independent Non-Executive Directors and considered them to be independent.

Audit Committee

As at 31 December 2019, the Audit Committee comprised 4 Independent Non-Executive Directors, Mr. Tse Hau Yin, Aloysius as the Chairman and Mr. Xu Erming, Madam Wang Hsuehming and Mr. Yeung Chi Wai, Jason as the members. The Audit Committee is responsible to the Board. The Charter of the Audit Committee clearly defines the status, structure and qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Audit Committee. The Audit Committee’s principal duties include the supervision of the truthfulness and completeness of the Company’s financial statements, the effectiveness and completeness of the Company’s internal control and risk management systems as well as the work of the Company’s Internal Audit Department. It is also responsible for the supervision and review of the qualifications, selection and appointment, independence and services of external independent auditors. The Audit Committee ensures that the management has discharged its duty to establish and maintain an effective risk management and internal control system including the adequacy of resources, qualifications and experience of staff fulfilling the accounting, internal control and financial reporting functions of the Company together with the adequacy of the staff’s training programmes and the related budget. The Audit Committee also has the authority to set up a reporting system on whistleblowing to receive and handle cases of complaints or complaints made on an anonymous basis regarding the Company’s accounting, internal control and audit matters.

In 2019, pursuant to the requirements of the governing laws and regulations of the places of listing and the Charter of the Audit Committee, the Audit Committee fully assumed its responsibilities within the scope of the clear mandate from the Board. The Audit Committee proposed a number of practical and professional recommendations for improvement based on the Company’s actual circumstances in order to promote the continuous improvement and perfection of corporate management. The Audit Committee has provided important support to the Board and played a significant role in protecting the interests of the independent shareholders.

In 2019, the Audit Committee convened 5 meetings and passed 2 written resolutions, in which it reviewed matters including but not limited to, certain financial services framework agreements entered into between China Telecom Finance and the Company, China Telecommunications and CCS, respectively, the continuing connected transactions contemplated thereunder and the applicable annual caps thereto, the Company’s annual and interim financial statements and quarterly financial results, assessment of the qualifications, independence, performance, appointments and remuneration of the external auditors, effectiveness of risk management and internal control systems, internal audit, implementation of continuing connected transactions, review of the operations in 2018 and the Charter of the Audit Committee, and the progress report on the preparation of the Environmental, Social and Governance Report. The Audit Committee reviewed the annual auditor’s report, interim review report and quarterly agreed-upon procedures reports prepared by the external auditors, communicated with the management and the external auditors in regard to the regular financial reports and proposed them for the Board’s approval after review and approval. The Audit Committee regularly received quarterly reports in relation to the internal audit and continuing connected transactions and provided guidance to the Internal Audit Department. Additionally, the Audit Committee reviewed the internal control assessment and the attestation report, followed up with the implementation procedures of the recommendations proposed by the external auditors, reviewed the U.S. annual report, and communicated independently with the external auditors twice a year.

Remuneration Committee

As at 31 December 2019, the Remuneration Committee comprised 3 Independent Non-Executive Directors, Mr. Xu Erming as the Chairman and Mr. Tse Hau Yin, Aloysius and Madam Wang Hsuehming as the members. The Remuneration Committee is responsible to the Board. The Charter of the Remuneration Committee clearly defines the status, structure and qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Remuneration Committee. The Remuneration Committee assists the Board to formulate overall remuneration policy and structure for the Company’s Directors and senior management personnel, and to establish related procedures that are standardised and transparent. The Remuneration Committee’s principal duties include giving recommendations to the Board in respect of the overall remuneration policy and structure for the Company’s Directors and senior management personnel and the establishment of a formal and transparent procedure for developing remuneration policy, and determining, with delegated responsibility by the Board, the remuneration packages of individual Executive Directors and senior management personnel including benefits in kind, pension rights and compensation payments (including any compensation payable for loss or termination of their office or appointment). Its responsibilities comply with the requirements of the Corporate Governance Code. The Remuneration Committee convened 1 meeting in 2019, during which it reviewed and discussed the remuneration proposals for the newly appointed Directors.

Nomination Committee

As at 31 December 2019, the Nomination Committee comprised 3 Independent Non-Executive Directors, Madam Wang Hsuehming as the Chairlady and Mr. Tse Hau Yin, Aloysius and Mr. Xu Erming as the members. The Nomination Committee is responsible to the Board. The Charter of the Nomination Committee clearly defines the status, structure and qualifications, work procedures, duties and responsibilities, funding and remuneration, etc. of the Nomination Committee, and it specifically requires that the Nomination Committee members shall have no significant connection with the Company, and comply with the regulatory requirements related to “independence”. The Nomination Committee assists the Board to formulate standardised, prudent and transparent procedures for the appointment and succession plans of Directors, and to further optimise the composition of the Board. The principal duties of the Nomination Committee include regularly reviewing the structure, number of members, composition and diversity of the Board; identifying candidates and advising the Board with the appropriate qualifications for the position of Directors; reviewing the Board Diversity Policy as appropriate to ensure its effectiveness; evaluating the independence of Independent Non-Executive Directors; advising the Board on matters regarding the appointment or re-appointment of Directors and succession plans for the Directors (especially Chairman and Chief Executive Officer). The Nomination Committee convened 1 meeting and passed 3 written resolutions in 2019, in which it performed a review of the structure and operations of the Board and the proposed candidates for Chairman, Chief Executive Officer, Directors and other related matters.

Independent Board Committee

Pursuant to the requirement under the Listing Rules, the Company convened 1 Independent Board Committee meeting in 2019, which all 4 Independent Non-Executive Directors attended and where it reviewed matters related to the deposit services and the proposed annual caps applicable thereto contemplated under the China Telecom Financial Services Framework Agreement and gave the relevant confirmation as well as submitted voting recommendations on these matters to the independent shareholders.

Number of Board and Committee Meetings Attended/Held in 2019

| Board Meeting | Audit Committee Meeting | Nomination Committee Meeting | Remuneration Committee Meeting | Independent Board Committee Meeting | Shareholders’ Meeting | |

|---|---|---|---|---|---|---|

| Executive Directors | ||||||

| Ke Ruiwen | 4/4 | N/A | N/A | N/A | N/A | 3/3 |

| Chen Zhongyue | 4/4 | N/A | N/A | N/A | N/A | 3/3 |

| Liu Guiqing* | 2/2 | N/A | N/A | N/A | N/A | N/A |

| Zhu Min | 4/4 | N/A | N/A | N/A | N/A | 3/3 |

| Wang Guoquan* | 2/2 | N/A | N/A | N/A | N/A | N/A |

| Yang Jie* | 1/1 | N/A | N/A | N/A | N/A | N/A |

| Gao Tongqing* | 3/4 | N/A | N/A | N/A | N/A | 2/3 |

| Non-Executive Director | ||||||

| Chen Shengguang | 3/4 | N/A | N/A | N/A | N/A | 2/3 |

| Independent Non-Executive Directors | ||||||

| Tse Hau Yin, Aloysius | 4/4 | 5/5 | 1/1 | 1/1 | 1/1 | 2/3 |

| Xu Erming | 4/4 | 5/5 | 1/1 | 1/1 | 1/1 | 3/3 |

| Wang Hsuehming | 4/4 | 5/5 | 1/1 | 1/1 | 1/1 | 3/3 |

| Yeung Chi Wai, Jason | 4/4 | 5/5 | N/A | N/A | 1/1 | 3/3 |

Note: Certain Directors (including Non-Executive Director and Independent Non-Executive Directors) could not attend some of the shareholders’ meetings and Board meetings due to other important business commitments. Such Directors have reviewed the relevant Board meeting agendas and papers before the meetings and authorised other Directors in writing to vote on their behalf so as to ensure their views were fully reflected in the meetings.

* On 4 March 2019, Mr. Yang Jie resigned from his positions as an Executive Director, Chairman and Chief Executive Officer of the Company due to change in work arrangement. On 19 August 2019, Mr. Liu Guiqing and Mr. Wang Guoquan were appointed as Executive Directors of the Company at the extraordinary general meeting of the Company. On 17 January 2020, Mr. Gao Tongqing resigned from his positions as an Executive Director and Executive Vice President of the Company due to change in work arrangement.

The Company will identify suitable Director candidates through multiple channels such as internal recruitment and recruiting from the labour market. The criteria of identifying candidates include but not limited to their gender, age, educational background, professional experience, skills, knowledge and length of service and capability to commit to the affairs of the Company and, in the case of Independent Non-Executive Director, the candidates should fulfill the independence requirements set out in the Listing Rules from time to time. After the Nomination Committee and the Board have reviewed and resolved to appoint the appropriate candidate, the relevant proposal will be put forward in writing to the shareholders’ meeting for approval.

Directors shall be elected at the shareholders’ meeting for a term of 3 years. At the expiry of a Director’s term, the Director may stand for re-election and re-appointment. According to the Articles of Association, before the convening of the annual general meeting, shareholders holding 5% or more of the total voting shares of the Company shall have the right to propose new motions (such as election of Directors) in writing, and the Company shall place such proposed motions on the agenda for such annual general meeting if there are matters falling within the functions and powers of shareholders in general meetings. According to the Articles of Association, shareholders can also request for the convening of extraordinary general meeting provided that 2 or more shareholders holding in aggregate 10% or more of the shares carrying the right to vote at the meeting sought to be held and they shall sign one or more written requisitions in the same format and with the same content, requiring the Board to convene an extraordinary general meeting and stating the resolutions of meeting (such as election of Directors). The Board shall convene an extraordinary general meeting within 2 months. The minimum period during which written notice given to the Company of the intention to propose a person for election as a Director, and during which written notice to the Company by such person of his/her willingness to be elected may be given, will be at least 7 days. Such period will commence no earlier than the day after the despatch of the notice of the meeting for the purpose of considering such election and shall end no later than 7 days prior to the date of such meeting. The ordinary resolutions to approve the appointment of Directors shall be passed by votes representing more than one-half of the voting rights represented by the shareholders (including proxies) present at the meeting. The Company will propose the shareholders of the Company to consider and approve the amendments to the Articles of Association in respect of the shareholders’ proposal rights at the 2019 Annual General Meeting. Please refer to the announcement published by the Company on 24 March 2020 for details.

Supervisory Committee

As at 31 December 2019, the Company’s Supervisory Committee comprised 5 Supervisors, including 2 Employee Representative Supervisors. The principal duties of the Supervisory Committee include supervising, in accordance with the law, the Company’s financials and performance of its Directors, managers and other senior management so as to prevent them from abusing their powers. The Supervisory Committee is a standing supervisory organisation within the Company, which is accountable to and reports to all shareholders. The Supervisory Committee usually holds meetings at least twice a year. The Supervisory Committee convened 2 meetings in 2019. The term of office for the 6th session of the Supervisory Committee lasts for 3 years, starting from May 2017 until the day of the 2019 Annual General Meeting to be held in year 2020, upon which the 7th session of the Supervisory Committee will be elected.

Number of Supervisory Committee Meetings Attended/Held in 2019

| Supervisors | Number of Meetings Attended/Held |

|---|---|

| Sui Yixun (Chairman of the Supervisory Committee) | 2/2 |

| Zhang Jianbin (Employee Representative Supervisor) | 2/2 |

| Yang Jianqing (Employee Representative Supervisor) | 2/2 |

| Xu Shiguang | 1/2 |

| Ye Zhong | 1/2 |

Note: Certain Supervisors could not attend some of the meetings of the Supervisory Committee due to other important business commitments.

External Auditors

The international and domestic auditors of the Company are Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP, respectively. The non-audit services provided by the external auditors did not contravene the requirements of the US Sarbanes-Oxley Act and therefore enabling them to maintain the independence.

A breakdown of the remuneration received by the external auditors for audit and non-audit services provided to the Company for the year ended 31 December 2019 is as follows:

| Service item | Fee (including value-added tax) (RMB millions) |

|---|---|

| Audit services | 81.46 |

| Non-audit services (mainly include internal control advisory and other advisory services) | 3.22 |

| Total | 84.68 |

The Directors of the Company are responsible for the preparation of consolidated financial statements that give a true and fair view in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board and the disclosure requirements of the Hong Kong Companies Ordinance, and for such internal control as the Directors determine is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. The Directors were not aware of any material uncertainties relating to any events or conditions which may cast a serious impact upon the Group’s ability to continue as a going concern. The statements by the external auditors of the Company, Deloitte Touche Tohmatsu, regarding their reporting responsibilities on the consolidated financial statements of the Company is set out in the Independent Auditor’s Report on pages 176 to 180 of this annual report.

Since the approval at the annual general meeting of the Company for the financial year 2012, the external auditors, Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP have provided audit services for the Company for seven consecutive years. The Audit Committee and the Board of the Company have resolved to reappoint Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP as the international and domestic auditors respectively for the financial year 2020, subject to the approval at the 2019 Annual General Meeting.

Risk Management and Internal Control Systems

The Board attaches great importance to the establishment and perfection of the risk management and internal control systems. The Board is responsible for evaluating and determining the nature and extent of the risks it is willing to take in achieving the Company’s strategic objectives, and ensuring that the Company establishes and maintains appropriate and effective risk management and internal control systems, and the Board acknowledges that it is responsible for the risk management and internal control systems and for reviewing their effectiveness. Such systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable but not absolute assurance against material misstatements or losses. The Board oversees management in the design, implementation and monitoring of the risk management and internal control systems. The Board takes effective approaches to supervise the implementation of related control measures, whilst enhancing operation efficiency and effectiveness, and optimising corporate governance, risk assessment, risk management and internal control so that the Company can achieve long-term development goals.

The risk management and internal control systems of the Company is built on clear organisational structure and management duties, an effective delegation and accountability system, definite targets, policies and procedures, comprehensive risk assessment and management, a sound financial accounting system, and continuing analysis and supervision of operational performance, etc. which plays a pivotal role in the Company’s overall operation. The Company has formulated a code of conduct for the senior management personnel and employees which ensures their ethical value and competency. The Company attaches great importance to the prevention of fraud and has formulated its internal reporting system, which encourages anonymous reporting of situations where employees, especially Directors and senior management personnel, breach the rules.

The Company views comprehensive risk management as an important task within the Company’s daily operation. Pursuant to regulatory requirements in capital markets of the United States and Hong Kong, the Company has formulated a featured 5-step risk management approach based on risk management theory and practice to achieve closed-loop management of risk identification, risk assessment, key risk analysis, risk reaction and risk management assessment. In continuously strengthening the risk process control and management and focusing on significant risk which may be encountered, the Company established a risk monitoring team, to follow and report the status of risk management and control regularly, improve the collection mechanism of risk-related information and identify the potential flaws of risk in a timely manner. Following the efforts made over the years, the Company has established a structured and highly effective comprehensive risk management system and has gradually perfected its comprehensive risk monitoring and prevention mechanism.

In 2019, pursuant to the requirement of code provision C2 of the Corporate Governance Code promulgated by the Hong Kong Stock Exchange, the Company concentrated resources on the prevention of significant potential risks, and strived to reduce negative effect from significant risks. The Company was not confronted by any major risk event throughout the whole year.

The Company has identified, assessed and analysed potential major risks faced by the Company in 2020, including economic and policy environment adaptation risks, business development risks and network and information security risks etc., and has put forward detailed response plans. Through strict and appropriate risk management procedures, the Company will ensure the potential impact from the above risks on the Company is limited and within an expected range.

In 2020, the potential significant risks and the major risk-prevention and countering measures are as follows:

Economic and policy environment adaptation risks: Facing the risks and challenges, such as the increasing downward pressure on the economy, the global outbreak of the novel coronavirus (COVID-19) epidemic since the beginning of 2020, the gradual impacts of regulatory policies’ adjustments in the industry, the official commencement of the 5G era, and the apparent increase in the sources of global unrest and risks, the Company will actively respond to the change in environment, implement the requirements of regulatory policies, innovate 5G applications and business models, deepening reform and innovation, expand ecological cooperation, improve overseas compliance management system and pragmatically promote the high-quality development of the Company.

Business development risks: Facing continuously increasing downward pressure on the development of the industry and the persistent upgrade of customers’ needs, the Company will focus on customers’ needs, improve the quality of service, expand the user scale, promote the corporate high-quality development and the in-depth cloud network integration, comprehensively apply new technologies, such as the 5G, cloud, Big Data, the Internet of Things and AI, to vigorously develop and promote new applications for government, enterprises and the public, and march steadily towards becoming a leading integrated intelligent information services provider.

Network and information security risks: Facing the risks and challenges of network and information security, the Company will speed up the construction of network information security integrated system and capabilities development, strengthen the protection of key information infrastructure and expand the network information security products and services, building a network information security ecology to provide users with reliable network information security protection.

The Company highly values the compliance with the laws and regulations of the PRC as well as the places of listing of the Company and where the Company’s business operations are located, strictly complies with all laws and regulations and timely and proactively incorporates the laws and regulations into the Company’s rules and regulations to protect the Company’s legitimate business management, maintain the Company’s legitimate rights and interests and support the corporate to achieve long-term healthy development target.

In August 2018, the Standing Committee of the National People’s Congress (the “NPCSC”) approved the E-Commerce Law of the People’s Republic of China, which was formally implemented on 1 January 2019. The E-Commerce Law consists of seven chapters and eighty nine articles which further regulate e-commerce activities conducted by relevant parties including e-commerce platform operators (“e-commerce platforms”). The E-Commerce Law defines and confirms, for the first time, the obligation of e-commerce platforms to protect the consumers’ security, and requires them to bear the corresponding responsibility when the obligation is breached. It further refines the regulation for the responsibility of intellectual property infringement on the e-commerce platforms, regulates the industrial and commercial registration and tax collection and management of e-commerce operators, requires e-commerce operators to publish information when terminating transactions at their own discretion, prohibits fabricating transactions and user comments to defraud and mislead consumers, prohibits the e-commerce platforms from abusing the dominant market position to exclude and restrict competition, regulates the rules of deposits collection and refund, requests the products participating in bidding ranking with the results marked therein.

On 23 August 2018, the Ministry of Industry and Information Technology promulgated the Notice of Ministry of Industry and Information Technology on Further Regulating Marketing Activities for Telecommunications Tariff Schemes (the “Notice”) which became effective from 23 August 2018. The Notice encourages fundamental telecommunications enterprises to provide a tiered discount pricing formula for tariff plans according to the usage amount of the users and simplify the structure of tariff packages. In formulating and implementing the tariff plans of bundled packages, the tariff plans for each respective service should also be provided, and the tariff rates disclosure policy should be improved. When promoting the tariff plans, the telecommunications enterprises shall fulfil its obligation to remind the users with respect to matters they shall pay attention to, including the restrictive conditions, the validity period and the charging principles. The same type of users with the same transaction conditions should be guaranteed with equal rights to select the tariff plans.

On 23 April 2019, the NPCSC promulgated the amended Anti-Unfair Competition Law of the People’s Republic of China (the “Anti-Unfair Competition Law”), which was formally implemented on the same day. The amendments to the Anti-Unfair Competition Law mainly involve the provisions regarding the trade secrets of intellectual property rights. First, the scope of trade secrets has been expanded through the incorporation of a catch-all description, which is no longer limited to “technical” or “business operation” information. Second, the scope of the trade secret infringer has been expanded. Apart from business operators, other natural persons, legal persons and non-legal entities have been included in the scope of the subject of liability for trade secret infringement. Third, given the practical situation of evolving infringement means and conducts, it has been clarified that misappropriation of trade secrets through electronic intrusion or indirect means, such as instigating, inducing and aiding others to acquire the right holder’s trade secrets, will constitute trade secret infringement. Fourth, the penalty on trade secret infringement has been increased. Fifth, in relation to the allocation of burden of proof for trade secret infringement in the civil trial procedure, it stipulates that the right holder may only need to provide preliminary evidences which can prove that the right holder has taken confidentiality measures and can reasonably indicate that the trade secret has been infringed. The amendments to the Anti-Unfair Competition Law strengthened the protection of intellectual property rights in China and had a positive impact on the establishment of a fair market order and protection of the legitimate interests of the right holders.

On 11 November 2019, the Ministry of Industry and Information Technology promulgated the Notice of the Ministry of Industry and Information Technology on Printing and Publishing the Regulations on the Management of Mobile Number Portability Service. The Regulations on the Management of Mobile Number Portability Service (the “Regulations”) became effective on 1 December 2019. The Regulations expressly allow the cellular mobile telecommunication users (excluding the users of Internet of Things) to apply for a change of the contracted fundamental business operator within the same local network area whilst retaining their phone numbers unchanged. Telecommunications business operators should strictly implement the relevant provisions on the real-name registration of users of mobile number portability service and ensure that the users whose mobile numbers have been transferred from other networks should be entitled to the same rights under the same conditions. Providing an important basis for the supervision and inspection of the telecommunications regulators, the Regulations explicitly require that in the course of providing the mobile number portability service telecommunications business operators should not engage in 9 types of prohibited conducts including to refuse, prevent or delay the provision of mobile number portability service to users without justifiable reasons, to restrict the users from switching to another network by means of expanding the scope of the agreement in relation the terms of service, to affect the quality of telecommunications service provided to the mobile number portability service users through technical measures such as interception and restriction, to conduct a comparative promotion, fabricate or disseminate false or misleading information or discredit other telecommunication business operators when promoting the mobile number portability service and the relevant tariff plans, to design special tariff plans and marketing schemes for mobile number portability service users, continue to occupy the mobile numbers transferred-in while the users have exited the network and to hinder or disrupt the normal operation of mobile number portability service by means of handling the mobile number transfer maliciously on behalf of the users, making complaints maliciously on behalf of the users, etc..

On 28 November 2019, the State Internet Information Office, the Ministry of Industry and Information Technology, the Ministry of Public Security and the State Administration for Market Regulation of the PRC jointly formulated the Method for Identifying the Illegal Collection and Use of Personal Information by Apps. It explicitly sets out the specific methods of identifying 6 types of illegal behaviours, i.e. failure to publish the rules for collection and use; failure to expressly specify the purpose, method and scope of collection and use of personal information; collection and use of personal information without the user’s consent; violation of the essential rules to unnecessarily collect personal information which is not related to the service provided; provision of personal information to others without prior consent; and failure to provide the function of deleting or correcting personal information as required by law or failure to publish information in relation to complaint or whistleblowing methods. It serves as a reference for the regulatory authorities to identify the illegal collection and use of personal information by apps and provides guidance for the self-inspection and self-correction of app operators and the social supervision.

Apart from implementing the latest and newly-amended laws and regulations in a timely manner, the Company also actively and closely monitors forthcoming changes in the relevant laws and regulations in order to strengthen the management of the relevant business operation behaviour, safeguards the effective adherence to relevant laws and regulations so as to ensure that the Company’s operations are in full compliance with the laws.

Since 2003, based on the requirements of the U.S. securities regulatory authorities and the COSO Internal Control Framework, and with the assistance of other advisory institutions including external auditors, the Company has formulated manuals, implementation rules and related rules in relation to internal control, and has developed the Policies on Internal Control Management and Internal Control Accountability Management to ensure the effective implementation of the above systems. The Company has all along continuously revises and improves the manuals and implementation rules in view of the ever changing internal and external operation environment as well as the requirements of business development over the years. While continuing to improve the internal control related policies, the Company has also been strengthening its IT internal control capabilities, which has improved the efficiency and effectiveness of internal control, enhancing the safety of the Company’s information system so that the integrity, timeliness and reliability of data and information are maintained. At the same time, the Company attaches great importance to the control and monitoring of network information safety. The Company persistently optimises the relevant rules and guidances, further defines the responsible entities and regularly commences the inspection of network safety and information safety in order to promote the enhancement of the awareness of network information safety and relevant skills and knowledge.

In 2019, based on external regulatory supervision, changes in policy environment, and requirements for prevention and control of the Company’s key risks, the Company also took into account various measures for deepening reform and innovation and change of business development. In order to focus on responding quickly to market demands and supporting business innovation and operational innovation for enterprises, the Company conducted annual revision of internal control manuals and implementation guidance. Branches at all levels further optimised and improved the list of internal audit authority, strengthened the Company’s internal supervision and stringent control on problem ratification, continuously improved internal control procedures and policies for capital utilisation, amended the protection for users’ information and customer service related procedures, perfected taxation and e-channel partner management; supplemented the contents of outsourcing management of sales outlets and property leasing management, IDC and Internet services management, capital and accounts management, guarantee and legal issues management.

The Internal Audit Department plays a vital role in supporting the Board, the management and the risk management and internal control systems. The functions of the Internal Audit Department, which are independent of the Company’s business operations, are complementary with the functions of the external auditors while the Internal Audit Department plays an important role in the monitoring of the Company’s internal management. The Internal Audit Department is responsible for internal control assessment of the Company, and provides an objective assurance to the Audit Committee and the Board that the risk management and internal control systems are maintained and operated by the management in compliance with agreed processes and standards. The Internal Audit Department regularly reports the internal audit results to the Audit Committee on a quarterly basis, and reports the internal audit results to the Board through the Audit Committee.

Annual Evaluation of Risk Management and Internal Control Systems

The Company has been continuously improving its risk management and internal control systems so as to meet the regulatory requirements of its places of listing, including the United States and Hong Kong, and strengthen its internal control while guarding against operational risk.

The Company has adopted the COSO Internal Control Framework (2013) as the standard for the internal control assessment. With the management’s internal control testing guidelines and the Auditing Standard No. 2201 that were issued by The Public Company Accounting Oversight Board (PCAOB) as its directives, the Company’s internal control assessment system is composed of the self-assessment conducted by the persons responsible for internal control together with the independent assessment conducted by the Internal Audit Department. In order to evaluate the nature of internal control deficiencies and reach a conclusion as to the effectiveness of the internal control system, the Company adopts the following 4 major steps of assessment: (1) analyse and identify areas which require assessment, (2) assess the effectiveness of the design of internal control, (3) assess the operating effectiveness of internal control, (4) analyse the impact of deficiencies in internal control, judge the nature of deficiencies in internal control and conclude on the effectiveness of the internal control system. At the same time, the Company rectifies any deficiencies found during the assessment. By formulating the amended “Measures for the Internal Control Assessment”, the “Manual for the Self-Assessment of Internal Control”, the “Manual for the Independent Assessment of Internal Control” and other regulations, the Company has ensured the assessment procedures are in compliance. In 2019, the Company’s Internal Audit Department initiated and coordinated the assessment of internal control all over the Company, and reported the results to the Audit Committee and the Board.

Self-assessment of internal control adopts a top-down approach. The Company continued to insist on 100% coverage of all units and also included the newly incorporated professional companies in the self-assessment system. Taking into account changes in internal and external environment and risk prevention focuses and focusing on key risk control areas in relation to the integrity and reliability of financial reports, compliance of operation and management and security of fund and assets, the Company insisted on risk-oriented principles and assessed the effectiveness of the design and implementation of internal control. The Company focused on the new situations and new risks identified in the process of new business development, new system implementation and organisational structure adjustment, the cross-level, crossdepartment and cross-system problems identified in the implementation of internal control and the rectification of problems identified in internal and external inspections and repeating problems. Taking full advantage of the leading role of business departments in the internal control self-assessment, the Company deepened the development of self-assessment and promoted the effective integration of self-assessment and daily operation and management through the professional lines of self-identification of risks, self-inspection of implementation and self-perfection of systems. In response to the internal control deficiencies identified during the self-assessment, the Company identified the responsibilities one by one, timely rectified the deficiencies, and effectively controlled and eliminated any potential risks. The Company also worked towards perfecting the systems and procedures, while continuously improving the effectiveness of the design and implementation of internal control.

The independent assessment of internal control targeted at extending to the full coverage of all the relevant units for a period of three years. On this basis, the scope of assessment was further expanded in 2019 and independent assessment was conducted on 6 provincial branches, 3 professional companies, 2 local networks and 2 departments in the headquarters office. To highlight the assessment focus, on the one hand, the Company focused on the establishment of internal control system and control environment and the quality and effects of internal control self-assessment and rectification work; while on the other hand, the Company enhanced the assessment on key areas and crucial aspects such as the authenticity of operating performance, fund management, procurement, business cooperation, business control and management, network information security and major economic decisionmaking procedures. The assessment on the departments in the headquarters office mainly focused on the effectiveness of the design of mechanism and system and the effectiveness of internal control for the vertical professional lines. The assessment on the professional companies mainly focused on corporate governance and control environment and specific risks relevant to their business characteristics in order to identify the deficiencies in the internal control management and rectification methods. The assessment on local networks served as the targeted independent assessment on and offered assistance to prefecture-level branches with imperfected self-assessed quality, which aimed to propel their management to enhance its awareness of internal control, identify the responsibility of internal control and strengthen fundamental management. During the year, risk prevention measures have been effectively implemented through different levels of independent assessments of internal control, which effectively enhanced the quality of assessment and the effectiveness of rectification, further enhanced the corporate self-healing abilities and safeguarded healthy corporate development.

Furthermore, the Company organised the risk management and internal control assessment team and other relevant departments to closely coordinate with the external auditors’ audit of internal control over financial reporting. The internal control audit covered the Company and all its subsidiaries as well as the key processes and control points in relation to material financial statements items. The external auditors regularly communicated with the management in respect of the audit results.

The Company attaches great importance to rectifying internal control deficiencies. Focusing on deficiencies identified through self-assessment, independent assessment and internal control audit at all levels, the Company required all units to carry out rectification measures and established a collaborative risk prevention mechanism to promote different professional reporting lines of various departments in the headquarters office to execute vertical supervision for the rectification work. The rectification work has been conducted in accordance with the measures to rectify the audit problem identified in order to achieve rectification results, perfect the systems and solidify the procedures. All subordinates entities proactively rectified deficiencies identified from the internal and external assessments on the request from the Company and increased the accountability for inadequate rectification in order to ensure the effectiveness of rectification work.

Through self-assessments and independent assessments conducted at different levels, the Company carried out multi-layered and full-dimensional reviews of its internal control system, and put its utmost efforts into rectifying the problems which were identified. Through this method, the Company was able to ensure the effectiveness of its internal control and successfully passed the year-end attestation undertaken by the external auditors.

The Board oversees the Company’s risk management and internal control systems on an on-going basis and the Board, through the Audit Committee, conducted an annual review of the risk management and internal control systems of the Company and its subsidiaries for the financial year ended 31 December 2019, which covered all material areas including financial controls, operational controls and compliance controls, as well as its risk management functions. After receiving the reports from the Internal Audit Department and the confirmation from the management to the Board on the effectiveness of the Company’s risk management and internal control systems (including Environmental, Social and Governance risk management and internal control systems), the Board is of the view that these systems are solid, well established, effective and sufficient. The annual review also confirms the adequacy of resources relating to the Company’s accounting, internal control and financial reporting functions, the sufficiency of the qualifications and experience of staff, together with the adequacy of the staff’s training programmes and the relevant budget.

Investor Relations and Transparent Information Disclosure Mechanism

The Company established an Investor Relations Department which is responsible for providing shareholders and investors with the necessary information, data and services in a timely manner. It also maintains proactive communications with shareholders, investors and other capital market participants so as to allow them to fully and timely understand the operation and development of the Company. The Company’s senior management presents the annual results and interim results every year. Through various activities such as analyst meetings, press conferences, global investor telephone conferences and investors road shows, senior management provides the capital market and media with important information and responds to key questions which are of prime concerns to the investors. This has helped reinforce the understanding of the Company’s business and the overall development of the telecommunications industry in China. Since 2004, the Company has been holding the Annual General Meetings in Hong Kong to provide convenience and encourage its shareholders, especially the public shareholders, to actively participate in the Company’s Annual General Meetings and to promote direct and two-way communications between the Board and shareholders. Meanwhile, the Company set up a dedicated investor relations enquiry line, for the purpose of providing a direct channel to address enquiries from the investment community. This allows the Company to better serve its shareholders and investors.

With an aim of strengthening communications with the capital market and enhancing transparency of information disclosure, the Company has provided quarterly disclosure of revenue, operating expenses, EBITDA, net profit figures and other key operational data, and monthly announcements of the number of access lines in service, mobile and wireline broadband subscribers. The Company attaches great importance to maintaining daily communication with shareholders, investors and analysts. In 2019, the Company participated in a number of investor conferences held by a number of major international investment banks in order to maintain active communication with institutional investors.

In 2019, the Company attended the following investor conferences held by major international investment banks:

| Date | Name of Conference | Location |

|---|---|---|

| January 2019 | DBS Pulse of Asia Conference 2019 | Singapore |

| January 2019 | Morgan Stanley China New Economy Summit 2019 | Beijing |

| January 2019 | UBS Greater China Conference 2019 | Shanghai |

| January 2019 | Deutsche Bank Access China Conference 2019 | Shenzhen |

| January 2019 | Crosby Peacock Series Corporate Day 2019 | Hong Kong |

| March 2019 | 22nd Credit Suisse Asian Investment Conference | Hong Kong |

| March 2019 | Morgan Stanley Ninth Annual Hong Kong Investor Summit | Hong Kong |

| March 2019 | Bernstein’s 5th Annual China Telecommunications Symposium | Hong Kong |

| April 2019 | Nomura Greater China TMT Corporate Day 2019 | Hong Kong |

| April 2019 | China Merchants Securities 5G Investor Seminar 2019 | Hong Kong |

| May 2019 | Deutsche Bank Access Asia Conference 2019 | Singapore |

| May 2019 | The 15th BOCI Investors Conference | Beijing |

| May 2019 | J.P. Morgan Global China Summit 2019 | Beijing |

| May 2019 | Morgan Stanley China Summit 2019 | Beijing |

| May 2019 | CLSA 24th China Forum | Qingdao |

| May 2019 | HSBC China Conference 2019 | Shenzhen |

| May 2019 | Macquarie Greater China Conference 2019 | Hong Kong |

| May 2019 | Goldman Sachs TechNet Conference – Asia Pacific 2019 | Hong Kong |

| June 2019 | HSBC GEMs Investor Forum 2019 | New York |

| June 2019 | CICC Investment Strategy Conference 2H2019 | Shanghai |

| June 2019 | UBS Asia TMT Conference 2019 | Hong Kong |

| June 2019 | ICBCI 2019 New Technology Corporate Day | Hong Kong |

| August 2019 | Morgan Stanley China TMT Conference 2019 | Beijing |

| September 2019 | Nomura China Investor Forum 2019 | Shanghai |

| September 2019 | CLSA 26th Investors’ Forum | Hong Kong |

| November 2019 | HSBC Global Investment Forum 2019 | New York |

| November 2019 | Morgan Stanley European Technology,Media & Telecom Conference 2019 | Barcelona |

| November 2019 | Morgan Stanley 18th Annual Asia Pacific Summit | Singapore |

| November 2019 | Bank of America Merrill Lynch 2019 China Conference | Beijing |

| November 2019 | CICC Investment Forum 2019 | Beijing |

| November 2019 | Goldman Sachs China Conference 2019 | Shenzhen |

| November 2019 | Credit Suisse China Investment Conference 2019 | Shenzhen |

| November 2019 | CITIC Securities Capital Market Annual Conference 2020 | Shenzhen |

| November 2019 | Daiwa Investment Conference 2019 | Hong Kong |

| November 2019 | Citi China Investor Conference 2019 | Macau |

| November 2019 | President Securities Investment Forum for the Emerging Trends 2020 | Taipei |

| December 2019 | Huatai Securities Investment Summit 2020 | Beijing |

| December 2019 | China Securities TMT Investment Summit 2020 | Beijing |

| December 2019 | Nomura 5G/Tech Corporate Day 2019 | Hong Kong |

The Company’s investor relations website (www.chinatelecom-h.com) not only serves as an important channel for the Company to disseminate press releases and corporate information to investors, media and the capital market, but also plays a significant role in the Company’s valuation and our compliance with regulatory requirements for information disclosure. The Company launched a responsive website with the latest technology, which allows automatic adjustment to fit for different screen resolution and user interface, assuring the best browsing experience of website content with desktop computers, laptops or mobile devices. This allows investors, shareholders, reporters and the general public to browse the latest information on the Company’s website with any device more easily and promptly anytime anywhere. The Company’s website is equipped with a number of useful functions including interactive stock quote, interactive KPI, interactive FAQs, auto email alerts of investors activities, downloading to excel, RSS Feeds, self-selected items in investors briefcase, html version annual report, financial highlights, investor toolbar, historical stock quote, adding investor events to calendars, content sharing to social media, etc.. In addition to setting up a dedicated investor relations enquiry line, a specialised appointment function to schedule a meeting with investor relations professionals was also launched on the Company’s website, to promote direct and close communication between the Company and investors, as well as to increase transparency.

The Company also strives to enhance the disclosure quality and format of annual report. The Company further enhanced the transparency of disclosure in environmental, social and governance areas, by following Environmental, Social and Governance Reporting Guide, Appendix 27 of Listing Rules, to report the Company’s achievements and key performance indicators on environmental protection, while also took initiative to add quantitative disclosures on social responsibility. The data disclosed was analysed and assessed by independent third party to ensure compliance with relevant requirements. The Company also actively seeks recommendations on how to improve the Company’s annual report from shareholders through survey, and prepared and distributed the annual report in a more environmentally-friendly and cost-saving manner according to the recommendations received. Shareholders can ascertain their choice of receiving the annual reports and communications by electronic means, or receiving printed version in English and/ or Chinese. The Company clearly and precisely delivered the messages about its strategies and goals in its 2018 Annual Report “Intelligent Transformation to Co-share Value of Innovation”, so that shareholders and investors can easily understand the Company’s development directions and focus. The print and online versions of 2018 Annual Report won a number of top accolades in international competitions, including being awarded in total six platinum awards and five gold awards, and ranked No. 3 of “Top 100 Reports Worldwide” (No. 1 in Asia Pacific) in “LACP 2018 Vision Awards”. In addition, the Company’s print Annual Report has earned 3 gold awards in “2019 International ARC Awards”. These prestigious honours reflect the unanimous worldwide recognition towards China Telecom’s tireless pursuit of excellence and globally leading performance on corporate governance and disclosure, on both conventional and digital channels.

The Company has always maintained a sound and effective information disclosure mechanism while keeping highly transparent communications with media, analysts and investors. Meanwhile, we attach great importance to the handling of inside information and have formulated rules on information disclosures and guidelines on inside information which encompass (including but not limited to) disclosure of sensitive information and rules on confidential information, identifying the scope of inside information, procedure and management guidelines on handling inside information. In general, the authorised speakers only clarify and explain on information that is available on the market, and avoid providing or divulging any unpublished inside information either as an individual or as a team. Before conducting any external interview, if the authorised speaker has any doubt about the information to be disclosed, he/she would seek verification from the relevant person or the person-in-charge of the relevant department, so as to determine if such information is accurate. In addition, discussions on the Company’s key financial data or other financial indicators are avoided during the blackout periods.

Shareholders

Details of shareholders by type and public float capitalisation can be referred to the Report of the Directors on pages 52 to 85 of this annual report.

Shareholders’ Rights

Procedures for convening of an extraordinary general meeting or a class meeting

According to the Articles of Association, shareholders who request for the convening of an extraordinary general meeting or a class meeting shall comply with the following procedures:

2 or more shareholders holding in aggregate 10% or more of the shares carrying the right to vote at the meeting sought to be held shall sign one or more written requisitions in the same format and with the same content, stating the proposed matters to be discussed at the meeting, and requiring the Board to convene an extraordinary general meeting or a class meeting thereof. The Board shall convene an extraordinary general meeting within 2 months. If the Board fails to issue a notice of such a meeting within 30 days from the date of receipt of the requisitions, the shareholders who make the requisitions may themselves convene such a meeting (in a manner as similar as possible to the manner in which shareholders’ meetings are convened by the Board) within 4 months from the date of receipt of the requisitions by the Board.

Procedures for proposing resolutions at the annual general meeting

When the Company convenes an annual general meeting, shareholders holding 5% or more of the total voting shares of the Company shall have the right to propose new motions in writing, and the Company shall place such proposed motions on the agenda for such annual general meeting if they are matters falling within the functions and powers of shareholders’ meetings.

Pursuant to the “Reply of the State Council on the Adjustment of the Notice Period of the General Meeting and Other Matters Applicable to the Overseas Listed Companies (Guo Han [2019] No. 97)” published in October 2019 to amend the requirements with respect to notice period, shareholders’ proposal right and convening procedures for general meetings applicable to joint stock companies incorporated in the PRC and listed overseas, the Company will propose to amend the Articles of Association of the Company regarding the requirements on the notice period of the general meeting, shareholders’ proposal right and convening procedures at the 2019 Annual General Meeting. Please refer to the announcement published by the Company on 24 March 2020 and the circular of the Company for the 2019 Annual General Meeting for the details of the amendments.

Process of forwarding shareholders’ enquiries to the Board or requesting for convening of an extraordinary general meeting or a class meeting or proposing new motions:

Shareholders may at any time send their enquiries, requests, proposals and concerns to the Board in writing through the Company Secretary and the Investor Relations Department.

The contact details of the Company Secretary are as follows:

The Company Secretary China Telecom Corporation Limited 28th Floor, Everbright Centre, 108 Gloucester Road, Wanchai, Hong Kong

Email:

Tel No.:

(852) 2877 9777

IR Enquiry:

(852) 2582 0388

Fax No.:

(852) 2877 0988